As the real estate market improves and low interest rates prevail, an increasing number of individuals are showing interest in property acquisition. This surge in interest has intensified competition, making it challenging for financial institutions to attract new home loan clients.

Loan officers, consultants, and mortgage lenders are recognizing the importance of lead generation in the home loan sector. Therefore, it’s crucial to explore innovative strategies for identifying potential home loan clients in the ever-evolving landscape of lead generation.

Despite a rise in home sales, securing mortgage leads remains a formidable task. The home-buying process is undergoing significant changes, necessitating an adaptation in our approach to identifying prospective buyers. The shift towards digital platforms is unmistakable, with 80% of potential borrowers preferring to conduct their research online and expressing a desire to complete the entire loan process digitally.

This digital preference highlights the opportunity to connect with potential clients online using effective strategies. In this post, we will outline 21 techniques to generate leads for home loans.

What are Home Loan Leads?

Home loan leads refer to individuals interested in obtaining a mortgage or home loan, typically for the purpose of purchasing or refinancing a property. These leads are individuals seeking assistance in navigating the home buying or refinancing process. Generating home loan leads involves attracting and engaging individuals in the market for mortgage services.

Potential home loan clients often engage with lenders to understand the intricacies of the loan process. These individuals are generally in the market for properties within their financial reach. In the real estate industry, attracting such prospective clients is crucial for business growth.

Lead generation can be achieved through various promotional tactics, including online advertising, content creation, partnerships with real estate agents, and other lead generation activities. The aim is to educate these potential clients about home loan options and assist them in the application process, ultimately converting them into customers. For mortgage lenders and brokers, acquiring and managing new clients is essential for expanding their business in the competitive realms of real estate and financial services.

Why Do You Need More Home Loan Leads?

Securing a higher volume of home loan leads is crucial for several reasons. Primarily, an increase in leads can significantly expand your pool of potential clients, enhancing the likelihood of converting these leads into actual customers.

For mortgage lenders, having a broad base of potential clients is instrumental in driving revenue growth and business expansion. Moreover, diversifying your leads can enable you to cater to a wide array of customer needs, encompassing various financial situations and housing preferences.

Furthermore, a steady influx of leads reduces dependence on a limited number of clients, fostering a healthier, more sustainable business model. Additionally, heightened competition among mortgage providers, spurred by an increase in leads, can stimulate innovation and elevate the quality of customer service.

Industry experts note a growing trend of individuals seeking larger homes, partly due to the prolonged periods of remote work. This shift underscores the escalating demand for home loans.

In essence, cultivating a robust pipeline of home loan leads is pivotal for the growth and competitiveness of any mortgage business, ensuring its relevance in the dynamic landscape of real estate and financial services.

Utilizing digital marketing services for home loan lead generation can greatly enhance your online visibility, reach a broader audience, and optimize the lead generation process, thereby improving your ability to attract suitable borrowers.

21 ways to Generate Leads for Home Loans

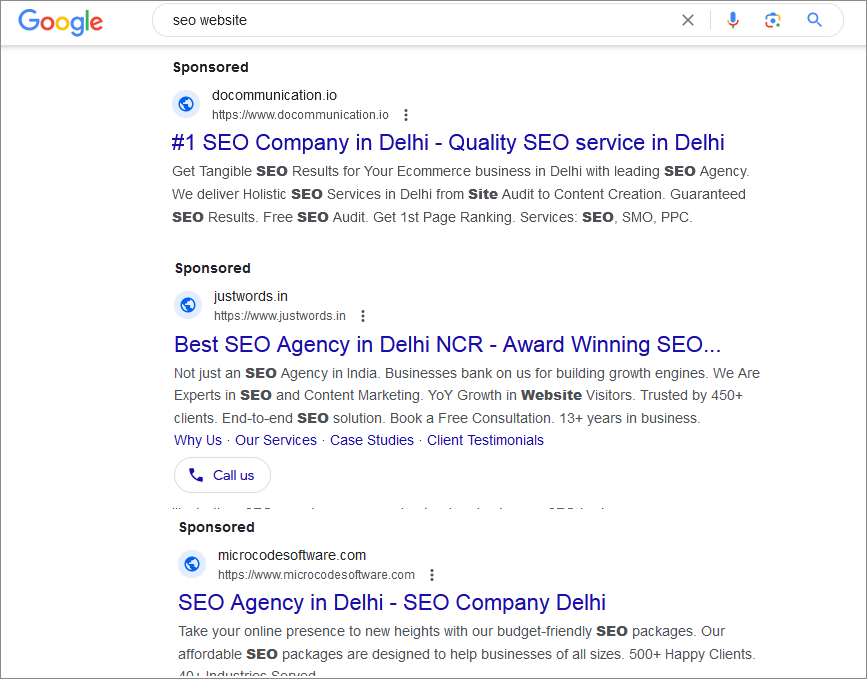

Use SEO Techniques to Build Online Presence

Employing Search Engine Optimization (SEO) is a formidable strategy for attracting mortgage seekers online. By optimizing your website to rank higher in search engine results, you can significantly increase your visibility to potential clients.

Keywords and Content Strategy

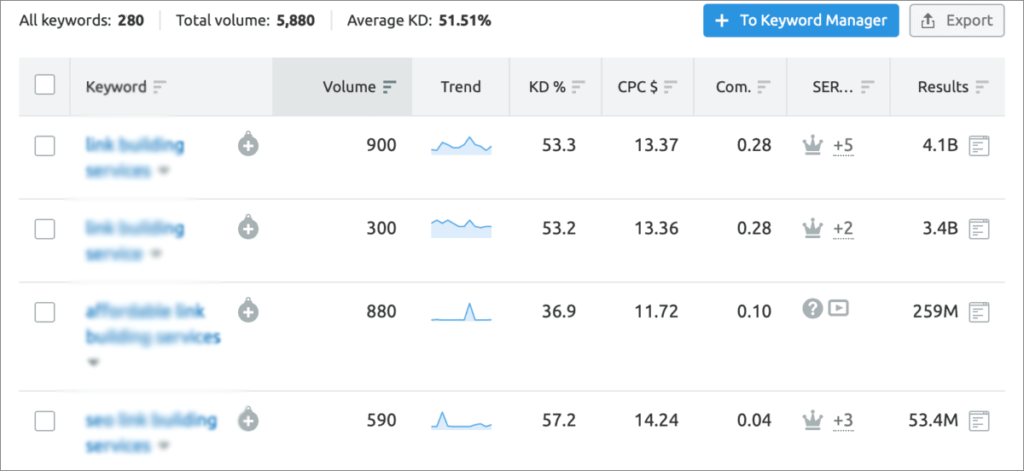

Integrating targeted keywords and crafting quality content can boost your website’s search engine ranking. Identify keywords that are highly searched yet face low competition. Utilize tools like Google Keyword Planner, Ahrefs, and SEMrush for keyword research. Crafting content that addresses these keywords not only aids in ranking but also in engaging potential clients by providing valuable information.

Your content strategy should aim to educate and assist your audience through their decision-making process. High-quality, informative content tends to perform better in search rankings.

Incorporating images and graphics can also enhance the appeal and visibility of your content, making your website more attractive to visitors. By providing valuable information, you can convert online interest into tangible business opportunities.

For instance, content addressing queries like “what is the interest for a $750K loan?”—which is frequently searched but not heavily competed for—can attract a significant audience. Identifying such niche topics and creating comprehensive content around them can be a key strategy in attracting and converting leads.

Local SEO

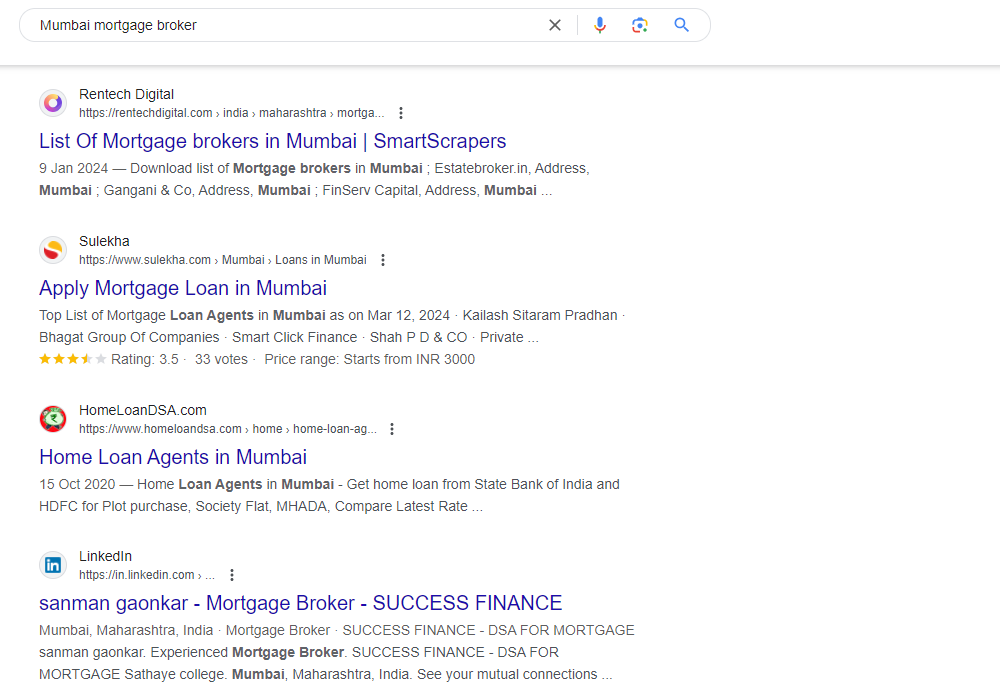

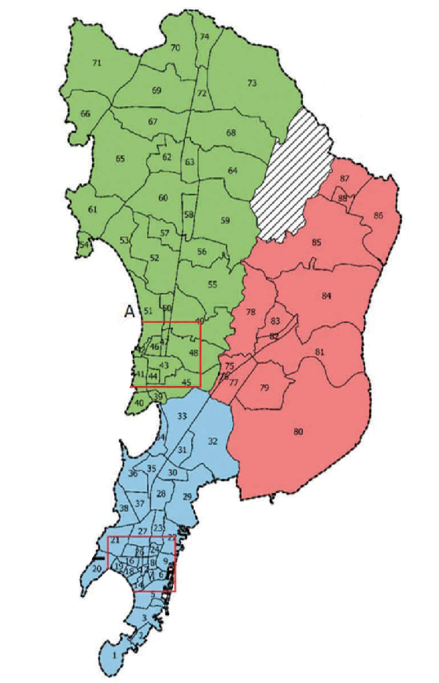

Local SEO is a powerful tool for attracting local clients to your mortgage business. Optimize your website’s metadata, including the title and description, to ensure your business is easily discoverable online by local prospects. For example, aiming to rank within the top three results for “Housing Loans” on Google can significantly increase your visibility.

Despite the competition among mortgage brokers, effective use of metadata can elevate your position in search results. Incorporate relevant keywords in your website’s title and description to enhance its search engine ranking.

Schema Markup

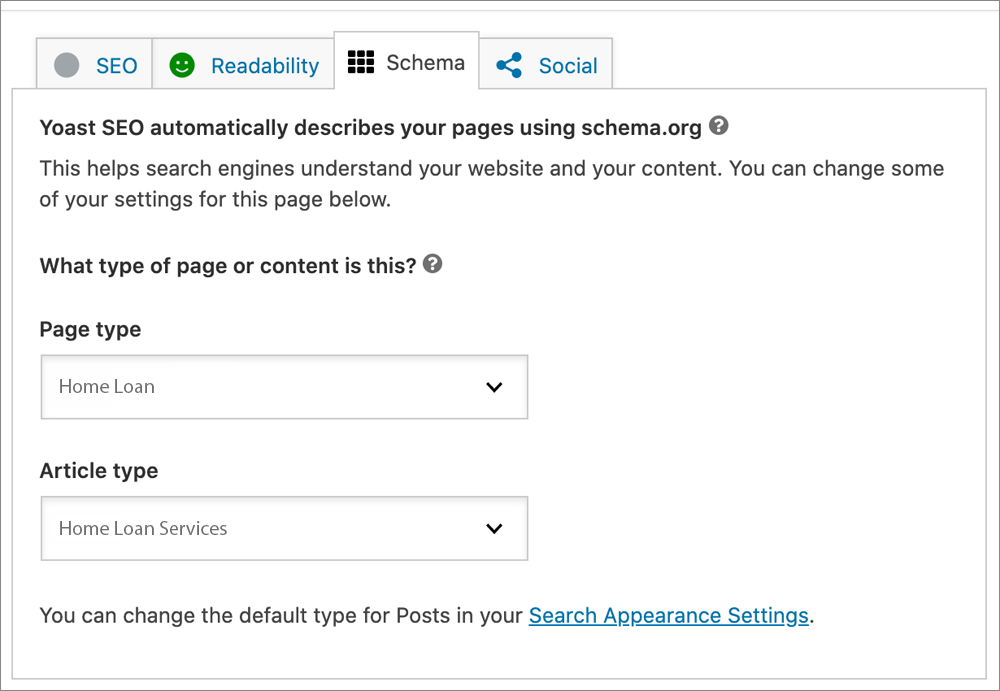

Schema markup is a form of structured data added to your website, making it easier for search engines to understand the content and provide more informative results to users. While the technical aspects of schema markup may seem daunting, many content management systems, including WordPress, offer built-in support. Utilizing Local Business Markup can help search engines more accurately identify and list your business.

Make Profiles for Your Business on Popular Platforms

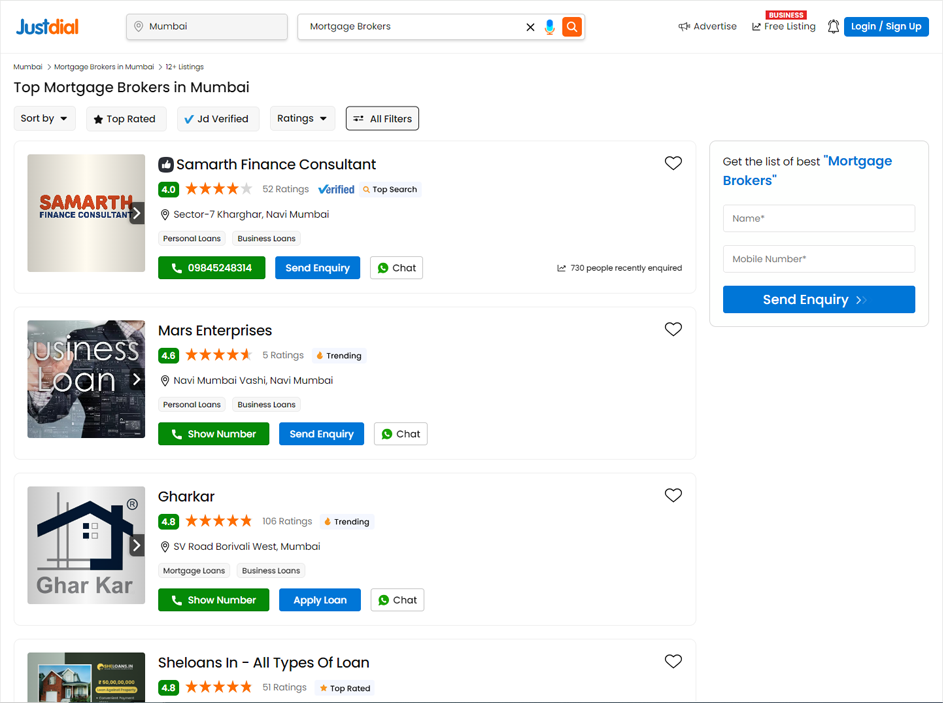

Establishing your presence on key local directories is one of the most straightforward methods to generate leads online. Ensure your business is listed in relevant local directories to maximize your local SEO efforts.

Local Listing

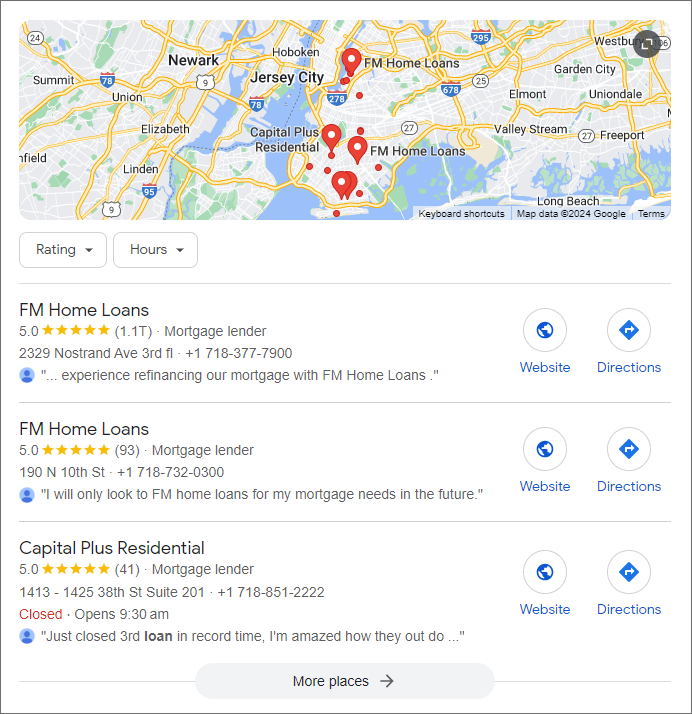

A Google My Business profile is an essential tool for connecting with local customers. Creating a profile is free and straightforward, and being listed on Google Maps enhances your credibility. This platform allows potential clients to easily find your location and access other important information. Encourage customer reviews to further build your online reputation. For instance, a search for “buy house in Brooklyn” on Google will display businesses listed on Google My Business in that area.

Directory Listing

Listing your services on platforms like Yelp and Angie’s List, as well as other local business directories, can attract customers actively seeking mortgage services. These leads are often highly qualified, as they come from users specifically searching for related services. Including your mortgage business in online directories increases visibility to those in need of home loans, broadening your potential client base.

MLS Listing

The MLS (Multiple Listing Service) is a comprehensive database used by real estate brokers to list properties for sale in the U.S. It features a wide range of information, including home listings, mortgage resources, and tools for calculating loan payments. Collaborating with real estate agents or brokers to feature your lending services in property listings can connect you with potential homebuyers.

Leverage Social Media and Create Brand Awareness

In the digital age, a robust social media presence is crucial for business success, particularly in the mortgage sector in the US, where approximately 80% of the population engages with social media platforms. This vast online landscape offers a fertile ground for connecting with potential home loan clients.

For mortgage providers, merely having accounts on various social media platforms is not enough. Engaging with the audience, addressing their inquiries, and actively participating in conversations are key to converting social media users into leads.

Social media also serves as an effective channel for advertising your services and consistently generating leads without the direct costs associated with traditional advertising. Below are strategies for leveraging different social media platforms to attract potential mortgage clients.

Generate Leads for Mortgages Using Facebook

Facebook’s widespread use makes it an ideal platform for reaching potential clients. Effective strategies include:

- Make a Facebook page to tell people about your business and what you offer.

- Engage with past and potential customers on Facebook.

- Post pictures and videos.

- Post customer reviews on your Facebook page.

- Share event details for real estate agents to connect with each other.

Use Instagram to Interact With Potential Customers

With its visual-centric format, Instagram is perfect for capturing the interest of prospective homebuyers looking for inspiration. To engage users effectively:

- Post photos of the homes that are ready to move in and are part of your partner network.

- Look for popular hashtags on Instagram and use them to make more people see your posts.

- Post customer reviews on your Instagram profile page.

- Share stories when you go to an event, take tours of homes, etc.

- Show off your success stories and good reviews in your profile to impress potential customers before they even reach out to you.

Also Read: Instagram for Business – All You Need to Know in 2024

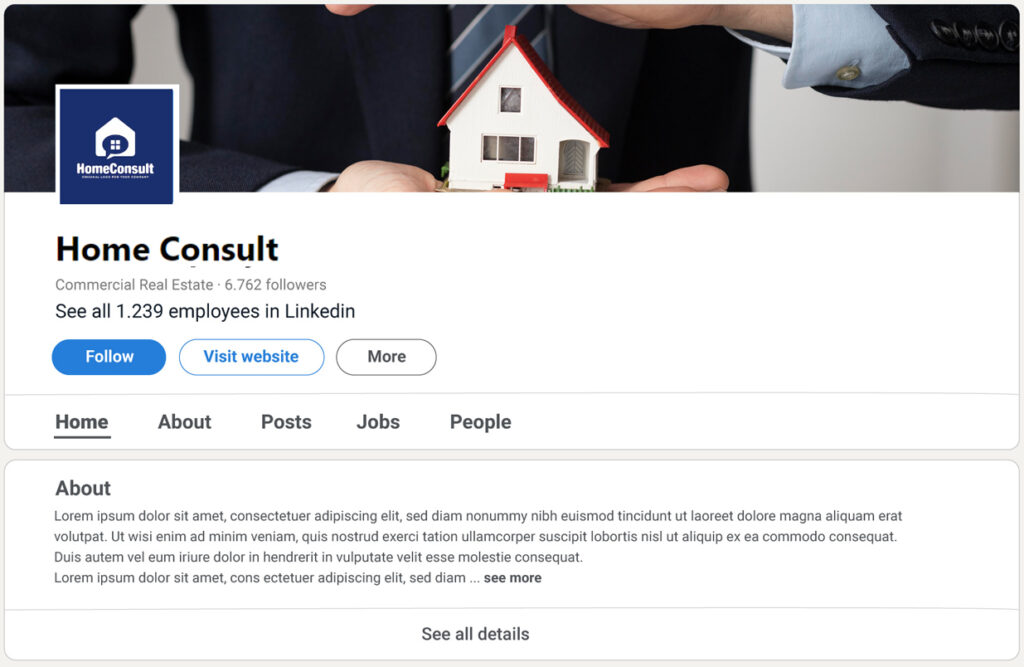

Find Potential Customers Using LinkedIn

LinkedIn, while professional in nature, is a valuable resource for connecting with potential homebuyers and investors. Strategies for leveraging LinkedIn include:

- Share news and information about the stock market to connect with people who are interested in getting a mortgage.

- Take surveys – it will help you know what the buyers think.

- Create a group on LinkedIn to connect with other professionals, learn about their problems, and offer ways to help.

Use YouTube to Create Useful Videos

As the leading video platform, YouTube offers an opportunity to reach a vast audience interested in mortgage-related content. To leverage YouTube:

- Search for people who have left comments or asked questions on similar videos made by your competitors.

- Make a YouTube channel. Put up videos with helpful information. Put your contact info in the video description.

- Share your videos on different social media platforms.

While social media can be an effective lead generation tool, managing interactions across multiple platforms can be challenging. Implementing a system to capture and manage leads is crucial to ensure no potential client is overlooked. CRM software tailored for mortgage lenders can streamline lead management, prioritizing follow-ups and ensuring efficient communication.

In summary, a strategic approach to social media can significantly enhance lead generation and brand awareness for mortgage providers. By offering valuable content, engaging with users, and utilizing CRM tools for lead management, mortgage businesses can capitalize on the vast potential of social media to grow their client base.

Also Read: From Novice to Pro: 80 Digital Product Ideas That Sell

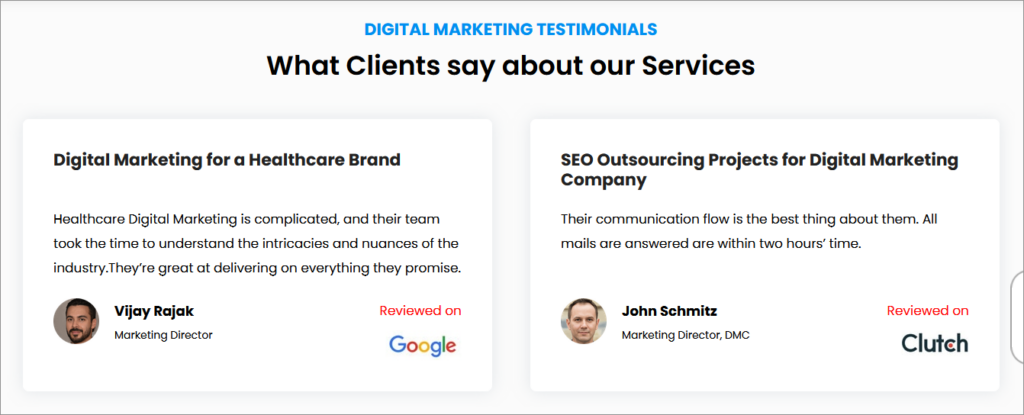

Use Customer Reviews to Create a Positive Image

Customer reviews play a pivotal role in shaping the perception of potential clients towards a business. In the mortgage industry, where trust and credibility are paramount, positive reviews can significantly impact decision-making.

Research from Bright Local highlights the importance of online reviews, revealing that 82% of consumers read reviews for local businesses, and 91% are more likely to engage with a company that has positive reviews. Conversely, encountering negative reviews can deter 82% of potential customers. Therefore, maintaining a positive online presence through customer reviews is essential for attracting new clients.

Leave Reviews on Local Listings, Website, and Social Media Profiles

Encouraging satisfied customers to leave reviews on various platforms, such as local listings, your website, and social media profiles, can bolster your online reputation. While soliciting reviews can be challenging and time-consuming, it’s a crucial step in building trust and recognition for your mortgage business.

Responding constructively to negative feedback can also demonstrate your commitment to customer satisfaction, often leaving a positive impression on those reading the reviews and responses.

Get Quick Leads by Using PPC Ads

Digital advertising, including pay-per-click (PPC) campaigns and social media ads, offers a direct route to potential clients. These advertising methods allow for precise targeting based on demographic and behavioral criteria, enhancing the effectiveness of your marketing efforts.

Google Ads

Google Ads can propel your mortgage business to the forefront of potential customers’ search queries by targeting specific keywords relevant to your services. This platform offers immediate visibility and can complement long-term strategies like SEO and brand awareness campaigns.

Google Ads allows for detailed targeting, enabling you to reach users based on various factors such as income, age, location, and gender, across search results, partner websites, and YouTube.

Facebook Ads

Facebook’s advertising platform is an excellent tool for reaching prospective clients with customized messaging. The platform’s user-friendly interface enables the creation of diverse ad formats, from single images and carousels to videos and text-based ads.

Effective targeting is crucial; without a clear understanding of your audience, your ads may fail to generate quality leads. Experimenting with different ad types can help identify the most effective format for engaging your target demographic.

Do Community and Referral Marketing

Community and referral marketing capitalize on word-of-mouth to promote your mortgage business. This grassroots approach can significantly amplify your reach and credibility.

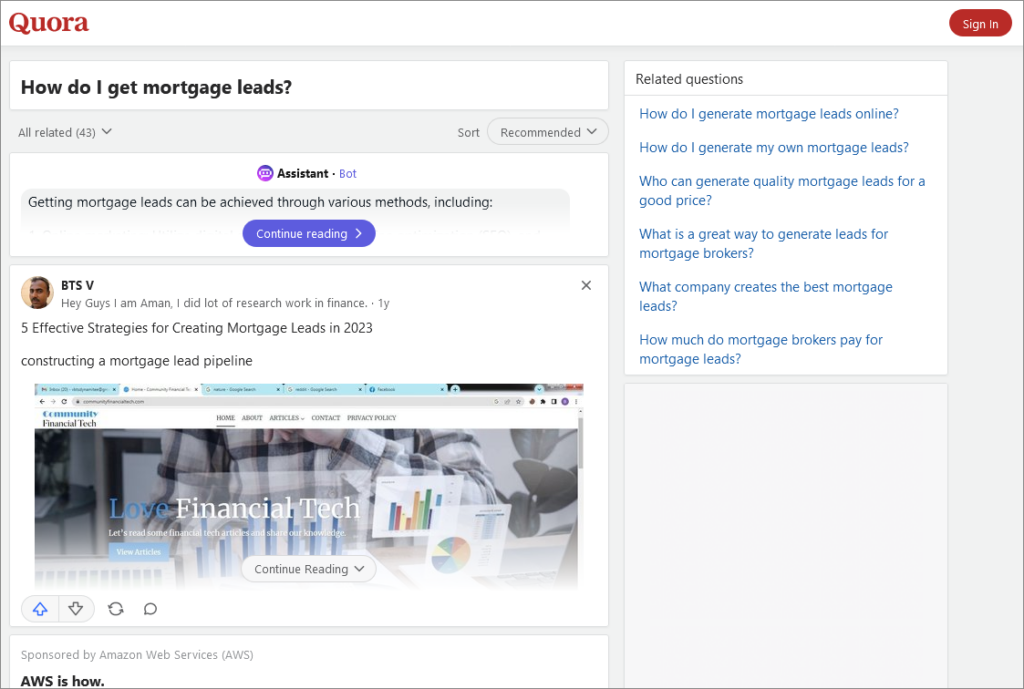

Quora

Quora is a platform where users seek answers to a myriad of questions, including those related to home loans. As a mortgage lender, engaging on Quora by providing insightful answers can establish your authority in the field.

Addressing both current and older questions can be beneficial, as it assists not only the original inquirers but also others who may stumble upon these questions in search of similar information. Exploring related questions can further extend your reach on the platform.

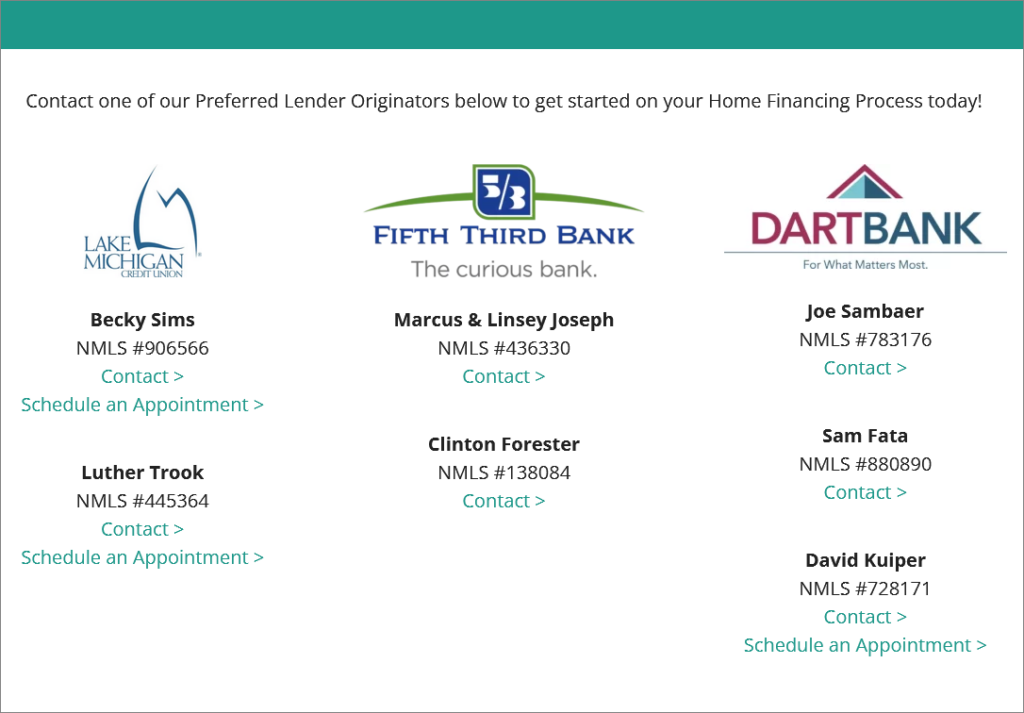

Partnership With Real Estate Agents

Collaborating with real estate agents and companies can be a strategic move. Platforms like Craigslist, Zillow, and HomeFinder are potential channels for such partnerships. By aligning with real estate companies, such as Eastbrook Homes and their chosen financial partners, you can tap into a ready pool of potential homebuyers interested in specific properties. These collaborations can result in a symbiotic relationship where both parties benefit from an expanded client base and enhanced service offerings to homebuyers.

Community Events

Engaging with your local community through events and seminars is invaluable for mortgage professionals. Such gatherings provide a platform to share expertise, offer advice, and foster trust with prospective homebuyers.

Moreover, community events are excellent for networking with real estate agents, builders, and financial advisors, potentially leading to fruitful referrals and partnerships. Regular participation can elevate your profile as an industry expert and connect you with potential clients.

Use Email Marketing

Find and Filter Leads Utilizing Email Marketing

Using emails to promote products or services is a good way to find new customers online. It might seem difficult because you need a list of email addresses for your email marketing campaigns.

However, you can make a list of people who are important to your business, and then start sending them emails to build a relationship and find potential customers. You can make a potential customer list by:

- Offering a way for people to sign up for updates from your blog or website articles

- Getting lists of potential customers from agencies

- Gathering email addresses from website tools such as loan eligibility checkers

- If you want to reach corporates, you can find their email addresses on their websites

- Look for contact information on social media profiles like Facebook, LinkedIn, Twitter

After that, you can keep an eye on things like when people open emails, click on links, unsubscribe, or have trouble receiving emails. Those who are reading your emails might want to do business with you. So, you can use this information to help your campaigns for turning potential customers into actual customers.

How Can You Use Email Marketing Effectively?

To effectively leverage email marketing, utilizing specialized software or a Customer Relationship Management (CRM) system is essential. These tools provide valuable insights into the performance of your email campaigns, allowing you to track engagement rates and identify areas for improvement, whether it’s refining the content, updating your mailing list, or optimizing send times.

Email marketing serves as a powerful channel to nurture and expand your prospect base, ultimately contributing to increased revenue. It’s an ideal platform for sharing market insights, exclusive promotions, and compelling offers. Incorporating clear calls to action encourages recipients to engage further with your business, driving traffic to your website and facilitating the collection of valuable lead information.

This process is instrumental in converting online interest into tangible business outcomes. However, it’s crucial to balance the frequency of your communications to avoid overwhelming your audience, focusing on the quality of content over quantity.

Provide Direct Benefits

Website Plugins

Integrating interactive features like mortgage calculators and chatbots on your website can significantly enhance the user experience for potential clients. Let’s delve into these tools:

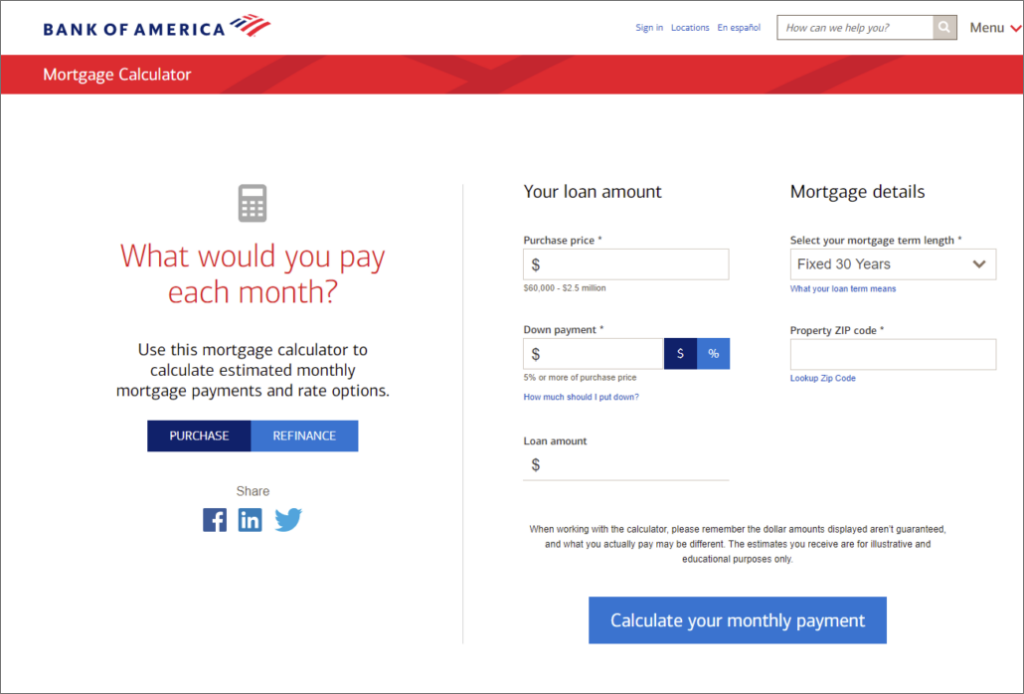

Mortgage Calculators

Mortgage calculators are invaluable for prospective homebuyers, aiding them in understanding their borrowing capacity. By incorporating these calculators on your website, users can easily estimate their loan affordability, monthly repayments, and potential savings.

Such tools not only assist users in their financial planning but also encourage prolonged engagement with your site. The data gathered from calculator interactions can be leveraged to tailor your communications with potential borrowers, making your outreach efforts more targeted and effective.

Contact Form

Incorporating contact form plugins on your website is a straightforward yet powerful method to capture leads. These forms simplify the process for users to inquire about home loans, prompting them to provide essential details such as their name, contact information, and loan requirements. The information collected through these forms is crucial for personalized follow-up, transforming website visitors into prospective clients for your mortgage services.

Live Chat

Integrating live chat plugins on your website can significantly transform user interactions, providing real-time communication for individuals seeking home loans. This feature allows for instant responses to queries, assistance with loan applications, and a personalized service experience.

Live chat fosters direct communication, building trust and accelerating the conversion of prospects into committed customers. It serves as an efficient tool for addressing urgent inquiries and offering immediate support, which is particularly valuable during the critical decision-making process of securing a home loan.

Popup Forms

Popup forms are effective in capturing the attention of website visitors, presenting an opportunity for engagement before they exit your site. These pop ups can prompt users to provide their contact information through sign-up forms, pose questions, or avail special offers.

Skillfully designed and timely deployed popup forms can attract potential home loan seekers, encouraging them to explore your services further or to subscribe for more detailed information. When executed correctly, popup forms can enhance lead generation and contribute to the growth of your customer base.

Downloadable Content

Ebooks and Guides

Creating comprehensive ebooks and guides on the home loan process is a strategic content marketing approach. These digital resources, packed with valuable insights and tips on securing home loans, serve as educational tools for prospective homebuyers. They cover various aspects of the mortgage process, including different loan types, application procedures, and financial planning.

By offering ebooks and guides, mortgage professionals can demonstrate their expertise, establish trust, and attract new clients. Providing such informative content not only educates the audience but also positions your business as a credible authority in the competitive home loan market.

Checklists

Home loan checklists offer a practical resource for individuals navigating the homebuying journey. These checklists outline essential steps and required documentation for the mortgage application process, guiding applicants through tasks such as obtaining credit reports, verifying income, and compiling property-related documents.

Mortgage professionals who provide clients with these checklists facilitate a more organized and efficient preparation for the loan application. Clear, step-by-step guidance simplifies the process for borrowers, improving communication with lenders and streamlining the path to loan approval. Through these checklists, mortgage experts can support their clients in achieving a smoother and more expedient mortgage acquisition experience.

Other Methods to Get Leads

Cold Calling

Cold calling involves reaching out to individuals who might be interested in a home loan but haven’t yet shown any explicit interest. Targeting specific demographics, such as clients of banks, accounting firms, and tax advisory services, can unveil promising opportunities, though this approach requires significant time and effort.

Mortgage professionals utilize cold calling to present their services, gain insights into potential clients’ financial situations, and offer assistance. The objective is to identify individuals contemplating a home loan and guide them toward initiating the application process.

Effective cold calling strategies encompass a well-prepared pitch, a friendly demeanor, addressing potential concerns, and providing valuable information to pique the interest of those unfamiliar with your home loan offerings. Mastery in cold calling can yield desired outcomes, and while it may seem daunting initially, it can become more manageable with practice and as leads start coming from various sources, allowing for a diversified approach.

Buy Leads

Many mortgage professionals find purchasing leads to be a straightforward and efficient method to expand their pool of potential clients. However, it’s crucial to exercise due diligence when selecting a lead generation company. Factors to consider include the company’s track record, customer satisfaction, and reputation within the industry.

Purchasing leads involves acquiring information about individuals actively seeking mortgage options. Mortgage companies often buy leads from specialized services dedicated to identifying and compiling data on potential mortgage seekers. This practice enables lenders to directly target a specific audience likely interested in obtaining a mortgage, streamlining their marketing efforts.

When buying leads, ensuring the quality and compliance of the leads is paramount. Employing strategic lead purchasing can significantly enhance home loan marketing efforts by attracting a larger volume of qualified prospects.

Wrapping Up

Navigating the complexities of generating quality mortgage leads online can be challenging, but implementing effective strategies can ensure a steady stream of potential clients. The techniques discussed provide a roadmap for identifying and engaging with prospects, thereby enhancing the likelihood of converting them into customers.

A successful mortgage business relies on a solid lead generation foundation, incorporating diverse tactics such as digital advertising, fostering relationships with real estate agents, offering tangible benefits, and engaging in networking opportunities. These strategies not only build trust but also broaden your reach to a wider audience of potential clients.

Adapting to the needs of homebuyers, exploring innovative lead generation methods, and collaborating with industry peers can significantly boost client acquisition for mortgage professionals. With the real estate market thriving, the present moment is opportune for securing new mortgage leads. Proactive efforts in lead generation can propel your mortgage business toward growth and success.

FAQs

What are the advantages if you work with real estate agents for getting home loan leads?

Partnering with real estate agents opens up access to a pool of prospective homebuyers, facilitating direct connections with potential clients. This collaboration ensures a reliable and quality source of leads, increasing the likelihood of converting prospects into actual clients.

How can I find people who are interested in getting a home loan for my mortgage business?

Leveraging online marketing tactics such as targeted ads, producing valuable content, and establishing partnerships with real estate professionals can be effective. Additionally, incorporating lead capture forms on your website and participating in local community events can draw in those interested in purchasing homes.

What important information do we need to gather while finding home loan leads?

Essential details include the prospective client’s name, contact information, financial standing, loan amount desired, and their specific needs. This information allows for personalized communication and enables mortgage professionals to tailor their services to each individual’s requirements.

Do buying leads for home loans work?

Purchasing leads can be effective when sourced from reputable providers. Ensure the leads are targeted, compliant with regulations, and aligned with your business goals. The success of converting these leads into clients hinges on personalized follow-up and a deep understanding of each lead’s unique needs.

RSS Feeds

RSS Feeds