The financial crisis in 2007-2008 severely impacted the housing market in the US, leading to a significant drop in demand for already-built homes. Families witnessed the declining value of their homes as new construction projects dwindled. It marked one of the most severe financial crises since the Great Depression.

The good news is that things have improved since then. The United States economy has been on the upswing, new construction projects are on the rise, and the housing market is looking promising. In 2018, people in the United States spent over $562 billion on building houses, and by 2022, this figure had increased to $910 billion.

This is particularly good news for professionals working in finance and mortgages who are seeking effective marketing ideas to attract homebuyers. The mortgage industry is vast and highly competitive. Don’t feel confined by your marketing strategy. Here are 11 outstanding home loan marketing ideas to enhance your marketing efforts.

Hiring digital marketing services for home loan marketing can significantly boost your online presence, target a wider audience, and streamline lead generation, ultimately increasing your chances of attracting qualified borrowers.

11 Great Home Loan Marketing Ideas

Find Your Niche

As a specialist in marketing mortgage loans with expertise in finance, have you considered focusing on a specific type of home loan? This can position you as an expert in that particular area.

Embracing specialization can significantly contribute to your business growth. While your overall strategy to attract customers may remain the same, tailoring your messaging to different target groups is crucial.

Types of Home Loans

Renovation Loans

If you are promoting loans for home renovations, your target audience includes individuals looking to enhance their existing homes or those in need of repairs for a prospective purchase or refinance. Consider testing a specific type of mortgage loan, such as an FHA loan, for home improvements.

When you want to help people find a new home that needs fixing, or you want to help them make their current home worth more money, you could focus on promoting renovation loans.

VA (Veterans Affairs) Loans

Focusing on VA loans means targeting veterans and military personnel. VA loans come with attractive perks, including no need for private mortgage insurance, competitive interest rates, and no upfront payments.

The Department of Veterans Affairs promises the loans, so you don’t have to pay for private mortgage insurance. Also, the prices are usually the cheapest available (compared to traditional bank loans), and you don’t need to pay anything upfront.

FHA (Federal Housing Administration) Loans

FHA loans may target first-time homebuyers or those with less-than-ideal credit scores. FHA loans offer approval options for credit scores as low as 500, with a 10% down payment, or a more favorable credit score of 580 or higher with a 3.5% down payment.

By deciding whether to excel in various aspects of home financing or specialize in a specific area, you can better understand your target audience and cater to their specific needs.

Make Your Mobile Website Better

Today, having a website isn’t enough; it’s crucial to ensure it’s user-friendly. With over 2 billion smartphone users, and more than half of all web page views originating from mobile devices, optimizing your mobile site is vital for marketing your home loans.

Research demonstrates that 85% of adults expect a business’s mobile website to be on par with or even superior to its desktop counterpart. Additionally, almost 90% of users won’t return to a website if their mobile experience is subpar. This is where Google’s Accelerated Mobile Pages (AMP) comes into play.

Accelerated Mobile Pages

AMP, a Google initiative, simplifies the creation of mobile-friendly content with a single click. AMP pages resemble regular web pages but omit certain technical features that can slow down loading times.

AMP also employs a cloud-based system to expedite content delivery to mobile devices. The key objective is to ensure your mobile website is swift and efficient, which can yield numerous benefits for your business.

Studies have revealed that slow-loading web pages drive more users away. A sluggish website could cause potential customers to turn to other lenders. Utilizing AMP guarantees that your web pages load rapidly.

Moreover, AMP enhances content distribution across various platforms and apps without limitations, allowing your content to reach an unlimited audience. A seamless, quick-loading mobile website increases your chances of attracting customers. Leverage AMP to ensure your mobile site performs exceptionally well.

Increase Email Open Rate

Email marketing for mortgage promotions can be highly effective. For every dollar spent on email marketing, an estimated return of $38 is anticipated. Research consistently underscores the effectiveness of email marketing in building brand recognition, acquiring new customers, generating sales, and retaining existing ones.

As a financial or home loan marketing expert, you’re likely already leveraging email marketing. However, are you achieving the desired results? With a staggering 205 billion emails sent daily, it’s essential to ensure your emails are opened. Let’s delve into some statistics first.

HubSpot reports that the average email open rate across all industries is 38.49%. Emails related to finance outperform this benchmark by 41.4%, while those in the retail sector achieve a 40.6% open rate. If you’re not reaching these percentages or seeking even better outcomes, it’s time to refine your subject line strategy.

Improve Your Email Subject Lines

In a world inundated with emails, crafting enticing subject lines is key to getting your emails opened. Research indicates that nearly half of email recipients open messages based on intriguing subject lines.

Encourage recipients to embark on something enjoyable, explore something new, or anticipate a special reward. Address their concerns and provide compelling reasons to read your email. Here are some useful tips:

- Keep the email subject concise, ideally between 6-10 words.

- Test the subject line’s appearance on both mobile phones and computers before sending.

- Stay focused on achievable promises, avoiding unrealistic claims.

- Understand and empathize with the recipient’s emotions.

- Offer unique, exclusive benefits that can’t be found elsewhere, such as special financing, speedy service, VIP treatment, and more.

Email remains a cornerstone of your mortgage loan marketing strategy. Don’t settle for anything less than your best; improve your email subject lines to maximize their impact.

Use Direct Mail for Millennials

Amid the widespread discussion of digital marketing, one might assume that sending physical mail is an outdated method to reach your audience. Contrary to this belief, mailing physical letters or flyers remains an effective strategy for marketing home loans.

This approach can be even more potent when combined with online advertising, as 72% of consumers prefer doing business with companies that employ multichannel marketing. Now, let’s focus on millennials, a generation increasingly interested in homeownership. Bank of the West reports that 42% of young adults have already purchased their own homes, with an additional 40% contemplating homebuying within the next 3-5 years.

This is precisely where you, as a financial marketing expert, come into play. According to The Financial Brand, millennials seek guidance, a well-rounded selection of financial products, and user-friendly tools. So, how should you connect with them? Could sending a letter be the best approach?

Surprisingly, nearly 80% of young adults read the direct mail they receive, and they exhibit a higher affinity for physical mail compared to other generations. It’s likely that they will not only pursue it but also share it with others. Furthermore, approximately 90% of people utilize the coupons they receive in the mail. Hence, it’s a valuable medium to promote your services and assist individuals in finding their dream homes.

Also Read: Startup Dreams: 20 Business Ideas for College Students

Share Pictures and Videos on Social Media

In 2018, over three billion people were active on social media platforms, with Facebook alone boasting more than two billion monthly users. Other platforms such as YouTube and Instagram also enjoyed significant usage.

This presents a golden opportunity for connecting with your customers via social media. However, standing out from the crowd and capturing people’s attention requires thoughtful strategies. Incorporating visuals, such as pictures and videos, is crucial for several reasons:

- Visual content is more shareable on social media compared to text-only content.

- Posts on Facebook that include images receive twice as much engagement as those without.

- Tweets featuring visuals garner 150% more retweets than text-only tweets.

- Instagram boasts over 500 million daily active users, emphasizing its visual nature.

To illustrate, here are noteworthy examples of visual content creation by mortgage lenders:

Rocket Mortgage – Quicken Loans

Quicken Loans established a content studio, investing significantly in video production to align their home loan advertisements with popular trends. They specifically targeted smartphone users and capitalized on key moments in social media, such as holidays, zoo events, and movie releases.

As a result, their social engagement surged, experiencing a two- to three-fold increase depending on the campaign. Their advertising campaign for “Avengers: Infinity War” even boosted website visits by 50-60%.

Even if you’re not partnering with major franchises like Marvel Comics, collaborating with prominent local or national businesses or public figures can enhance your credibility and attract a broader customer base.

Chase Home Lending

Chase, as the second-largest originator of loans in America, streamlined the online home loan application process for their customers. They effectively communicated this through their social media channels, featuring an educational YouTube video titled “The Anatomy of Choosing a Mortgage Product.” In under 90 seconds, they simplified complex financial topics.

Share your mortgage expertise with your social media followers, regardless of your level of knowledge. Your insights can be invaluable in demystifying the mortgage loan market, which can often seem perplexing. By building trust with customers and laying the foundation for future business relationships, you’re positioning yourself for success.

New American Funding

Originating as a small call center, this lender has grown into a major mortgage company. They actively utilize their social media presence to disseminate information about their diverse lending opportunities, including loans that don’t fall under the category of qualified mortgages.

Their mission is to enable everyone to pursue their dream of homeownership, employing technology and marketing to connect with young adults and borrowers from diverse backgrounds.

If you aim to engage with a specific demographic, leverage social media to share tailored information. Forge emotional connections and demonstrate an understanding of their aspirations. The more connected they feel, the greater the likelihood of earning their trust and business.

Automate Marketing Strategies

Implementing mortgage marketing automation can simplify your marketing efforts by automating various tasks. Technology enables you to consistently send messages through print, email, texts, or social media, which you may already do to some extent.

We’ve discussed ways to leverage email, social media, and direct mail for your mortgage business. Now, let’s explore how you can automate these processes to save time and money while nurturing connections with potential homebuyers.

Automate Email Marketing

Automating certain email communications not only saves you time but also ensures consistent messaging. Consider the benefits of automated email series or drip email campaigns.

Over time, automated emails can boost your product sales by up to 50%, provided they are well-crafted messages, addressing the right topics at the appropriate times. Maintaining regular contact with your customers helps them remember your services and ensures you stay on top of their minds when they are ready to explore home loan options.

Imagine someone joining your email list or sharing their contact information in exchange for valuable content, such as an e-book or report. This is where automation takes the reins. What will you convey to convince them to choose your services? When planning automated emails, focus on delivering genuinely helpful information tailored to your customers’ needs.

For example, it wouldn’t make sense to send home improvement-related emails to individuals who have just purchased their first home. Aim to send at least one email each month, avoiding the temptation to bombard recipients with more than one email per week.

Guide recipients to contact you or visit your website through a clear and direct message. Utilize informative content to direct them toward your website and social media profiles. Automation empowers you to disseminate valuable content effortlessly.

Automate Social Media Marketing

Use automated emails to steer customers toward your website and social media channels. Additionally, scheduling regular social media posts is a wise strategy.

Consistent and frequent social media posting is crucial. As a knowledgeable figure in the realm of home loans, you should regularly share valuable information. Consider these content ideas:

Videos: Craft brief videos to educate, share success stories, or offer advice.

Educational Content: Inform your audience about securing financing for a home purchase, addressing common questions.

Emotional Content: Owning a home may seem like a dream, but it’s attainable. Share inspiring success stories showcasing how you’ve helped dreams become reality. This kindles hope in your customers, who have their aspirations and believe you can fulfill them.

If you suspect that your social media posts aren’t garnering adequate visibility, consider crafting a weekly summary post encompassing your key content. Alternatively, send your contacts a weekly post summary with links, enabling them to access the content at their convenience.

Automate Direct Mail Marketing

Statistics indicate that direct mail remains an effective marketing tool, appealing not only to young audiences but to diverse demographics. Nearly all direct mail is opened, with almost half of the recipients preserving it for future reference. In essence, this method offers substantial returns on investment.

Automation can enhance the efficacy of your direct mail marketing efforts, particularly when personalization is a key focus. Personalizing direct mail letters increases the likelihood of recipients opening and responding to them.

Approximately 85% of individuals expressed a greater inclination to open personalized mail, potentially boosting response rates by up to 50%. Consider employing transparent envelopes with customized messages for your customers, showcasing special interest rates or expected loan amounts. Leverage your direct mail data to tailor mortgage offers that align with the customer’s needs, thereby optimizing your results.

Also Read: Best 75 Profitable Small Business Ideas in India for 2024

Improve Your Networking Skills

Despite the plethora of home loan marketing strategies discussed earlier, the importance of face-to-face interactions cannot be overstated. Some potential clients base their decision to do business with you on their personal, in-person experiences. The Virgin Group conducted a study revealing that interpersonal communication holds paramount significance. Here are several ways to establish connections with people:

Business Gatherings

Explore opportunities to attend local chamber of commerce events tailored for business professionals to network. These gatherings provide an avenue to foster neighborhood relationships. Taking your involvement a step further by becoming a chamber ambassador can increase your visibility and deepen your connections with fellow members.

Professional Associations

Engaging in discussions and idea sharing within your industry can connect you with numerous potential clients. Seek avenues to participate without an overt sales agenda. For instance, consider volunteering for the association’s marketing and promotional efforts. This not only demonstrates your value but also cultivates relationships with peers.

Volunteer Activities

Investing your time and expertise in community service initiatives not only benefits your community but also forges valuable personal and professional connections. Contributing to volunteer events offers a sense of fulfillment and enriches both your personal and career life.

Create Quality Content

Avoid resorting to generic sales pitches, as individuals seeking home loans seek knowledge and valuable information. They desire clear and transparent insights from banks and lending institutions. Brands must shift away from aggressive product promotion and instead embrace the role of helpful guides for their customers.

Openly addressing questions and providing essential information empowers customers to make informed choices. Utilize discovered insights to generate content ideas:

Start an “Ask an Expert” series: Produce concise and comprehensible videos or blog posts addressing common queries such as “How much should I save for a down payment?” or “What are pre-closure costs?”

Create an easy-to-use EMI calculator: Go beyond a standard calculator by offering tools that facilitate loan comparisons, prepayment calculations, and repayment schedule visualization. Such resources not only maintain borrowers’ interest but also instill confidence in your expertise.

Make infographics that explain difficult ideas: Simplify complex concepts like floating interest rates and compound interest in a visually engaging manner, making them more accessible to a broader audience.

Pay Attention to Local SEO

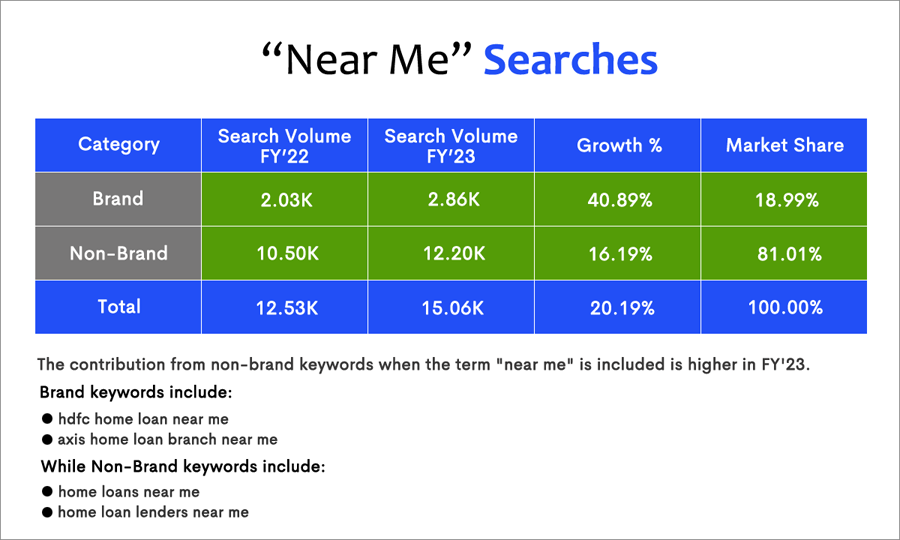

An increasing number of individuals seek lenders in close proximity to their residences. In the past year alone, searches for local lenders have surged by 25.74%. This trend underscores the growing preference for borrowing from nearby sources, a phenomenon particularly pronounced in smaller cities. It presents a significant opportunity for brands to connect with local borrowers and distinguish themselves from the competition.

Analyzing data for larger urban centers reveals substantial disparities in search volume. In contrast, smaller cities witness a substantial upsurge in the quest for home loans, signaling an emerging market that has yet to be fully tapped. Here are some strategies to optimize your website and content for local customers:

- Instead of relying solely on common and highly competitive terms like “home loan,” incorporate “near me” and city-specific phrases when selecting keywords. Examples include “Searching for a reliable home loan in the Bay Area” or “Need assistance with Queens’ home loan EMI calculations.”

- Devote separate web pages to each city in which you operate. Highlight the presence of local offices, any exclusive offers, and success stories from satisfied customers in the area.

- Recognize the growing prevalence of voice assistants like Siri or Alexa for local inquiries. Ensure that your website and content are structured to respond effectively to natural language queries, such as “Who are the top mortgage loan lenders near me?”

- Ensure the accuracy of your Google business listing, maintaining up-to-date information, including photos, contact details, and service offerings. This facilitates local discovery and fosters trust among potential borrowers.

Create Good Campaigns

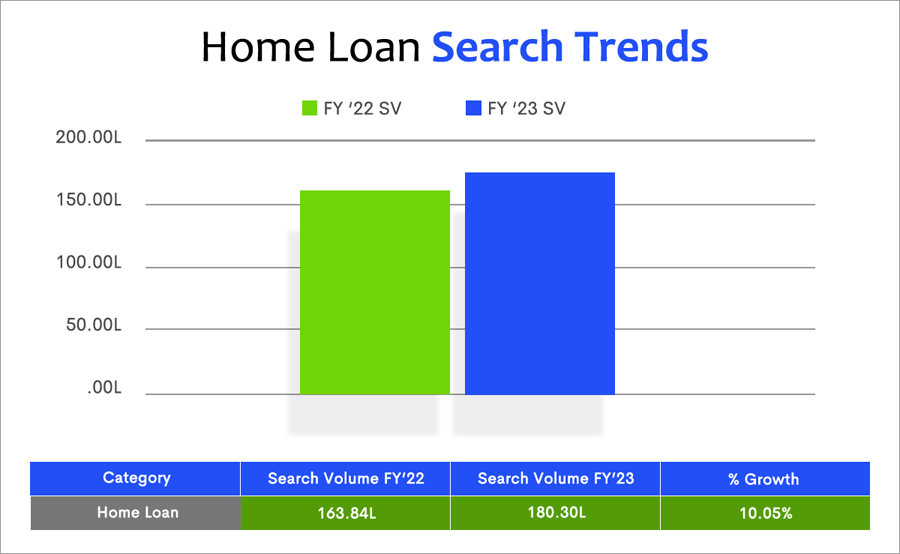

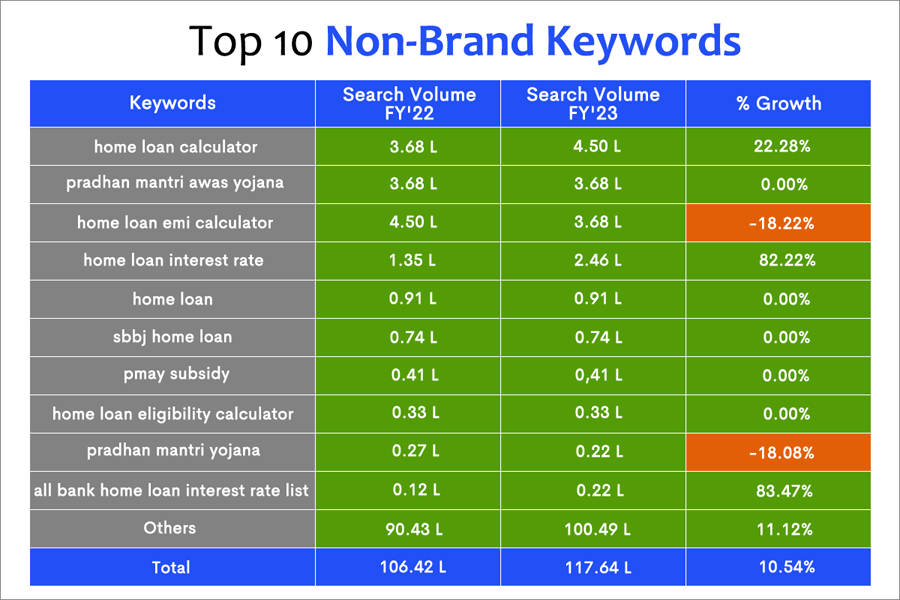

By understanding customer preferences, companies can develop marketing campaigns that effectively target the right audience, attract potential clients, and cultivate loyalty. Interest rates remain the most frequently searched aspect, accounting for 28.34% of all home loan-related queries.

Maintain competitive pricing and prominently feature these competitive rates in your marketing efforts. Don’t hesitate to showcase special offers or limited-time discounts. Following closely, the “Home loan EMI calculator” ranks as the second most searched term, with 3.68 million monthly queries.

Facilitate affordability for your customers by offering a user-friendly monthly payment calculator. Ensure its prominent placement on your website and landing pages, and incorporate it into your marketing materials.

Numerous individuals seek the best home loan options under $50,000. Tailor your marketing strategies to cater to the unique needs of these customers. Additionally, provides solutions for first-time homebuyers and those with less-than-ideal credit scores.

Explore Other Languages

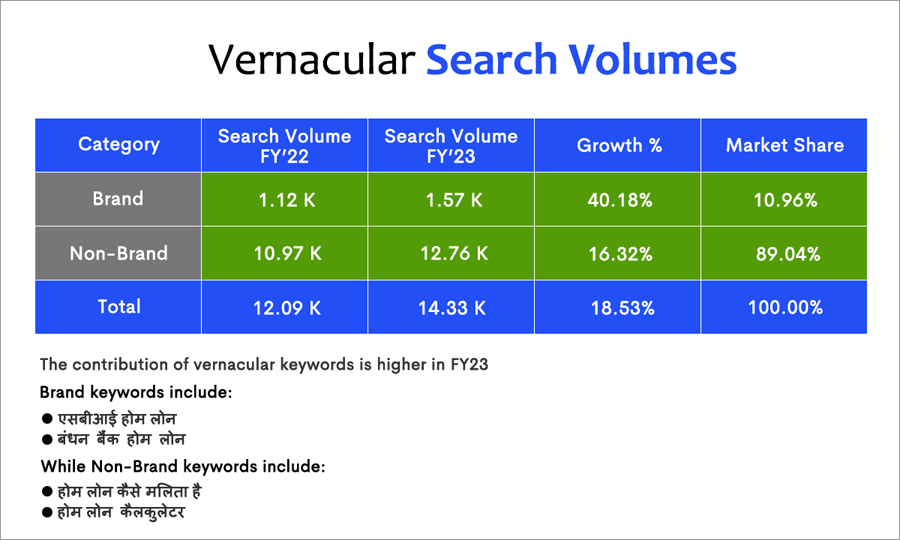

The home loan market transcends mere numbers and formulas; it revolves around establishing meaningful connections with individuals. In a country as diverse as ours, these connections often thrive when people communicate in languages and dialects specific to their regions.

More individuals are gravitating toward everyday language when conducting online searches. This presents an excellent opportunity for brands to engage with people in a manner that feels natural to them. Increasingly, people are conducting searches in their native languages.

The search for home loans in languages like Spanish or Chinese has seen a significant upswing, with search volumes surpassing those in English over the past year. This trend underscores the growing comfort among residents of smaller cities in using their native language, particularly when seeking financial assistance. Understanding and addressing the needs of this demographic can significantly expand your reach. Here’s how to leverage vernacular languages to reach a wider audience:

- Generate blog posts, informative images, and videos in languages spoken within your region. Address common queries individuals pose during search engine queries, offering relevant information tailored to specific areas.

- Identify commonly used terms related to home loans in various languages. Utilize tools like Google Keyword Planner to pinpoint popular words employed by individuals when conducting searches in different languages.

- Craft dedicated landing pages in different languages, incorporating tailored prompts and contact details for each language. This demonstrates your understanding of their needs and respect for their preferred language.

- Partner with bloggers and social media influencers fluent in the languages of your target audience. They can create engaging posts about your home loan offerings, effectively connecting with the community members you aim to reach.

Turn Your Marketing Ideas for Home Loans Into Reality

Now that you have a solid set of strategies for promoting home loans, it’s time to put them into action and reap the rewards. Decide on the specific focus area or topic for your campaign. Will you concentrate on a single type of home loan, or will your campaign encompass all available options?

Once you’ve made that determination, ensure your mobile website is fully optimized. With more people accessing websites via mobile devices than computers, a well-functioning mobile site is essential. Accelerated mobile pages will help you achieve faster loading times, accelerating your path to success.

Next, consider your message delivery method. Sending an email is convenient, but ensuring your recipients open it can be a challenge. To increase the likelihood of email engagement, employ attention-grabbing subject lines to entice more opens.

Are your home loan advertisements targeting young adults? Many of them aspire to homeownership, making direct mail an effective means of capturing their attention. Research indicates that young adults are receptive to direct mail, which can help you reach a broader audience interested in your products or services. This approach can yield favorable results. Additionally, incorporating images or videos into your social media posts can enhance engagement, as visual content tends to garner more shares than text-only posts.

Leveraging automation for scheduling your social media posts, emails, and direct mail marketing can save you time, and money, and enhance your return on investment (ROI). Lastly, remember the importance of building connections. Virtually every survey underscores the significance of in-person meetings in maintaining robust business relationships. Establish trust and respect by engaging with individuals in your community, and demonstrating your care for their well-being. The benefits will undoubtedly outweigh the effort invested.

To Conclude

Understanding the needs and preferences of individuals seeking home loans is of paramount importance in modern marketing. This understanding can significantly enhance your business’s marketing efforts and overall success. Gone are the days of basic advertisements; today, data-driven insights are the linchpin of effective marketing strategies.

By harnessing the information gleaned from individuals’ online searches, companies can craft advertisements that effectively reach and persuade those interested in obtaining a home loan. By aligning campaigns with the desires and preferences of the target audience, businesses can substantially increase engagement and conversions, even in the face of fierce competition.

Leveraging popular search topics empowers you to refine your home loan marketing efforts and create a more strategic approach. This approach not only attracts the right customers but also fosters trust and paves the way for a prosperous business. In the competitive landscape of home loans, understanding and delivering what your customers desire is paramount to achieving success.

FAQs

How to reach out to people in your area to sell more home loans?

Participate in community events, support local projects, and collaborate with real estate agents and community groups. Hosting workshops or webinars about the home-buying process and securing a mortgage can position your brand as a local expert, fostering trust and attracting potential homebuyers.

Do referral programs work well for advertising home loans?

Yes, referral programs can be highly effective. Encourage satisfied customers, real estate professionals, and business partners to recommend your services to others. Offering incentives, such as reduced fees or gift cards, to both the referrer and the new client can motivate and reward successful referrals.

How much does it matter to have a user-friendly website when advertising home loans?

An intuitive and user-friendly website is crucial for home loan advertising. Ensure that your website provides valuable information about the mortgage application process and clearly outlines how visitors can contact you for further assistance or to initiate an application. Given the prevalence of mobile device usage, it’s also essential to optimize your website for mobile users.

Can personalized communication make home loan advertising better?

Absolutely, personalized communication through customized emails and direct mail can significantly enhance home loan marketing. Tailor your messages to directly address the specific needs and concerns of individuals seeking to purchase a home. This personalization establishes a more meaningful and trustworthy connection.

RSS Feeds

RSS Feeds